The Fund aims to build an investment portfolio centered on a diversified pool of investment tools and assets (including a wide range of geographies and sectors) in addition to strategic investments in order to ensure sustainable long-term returns.

OIA applies a carefully structured investment strategy in a detailed and flexible manner, exhibiting a cautious approach in adhering to high standards in managing risk. The Fund also adopts global best practices in developing its investment strategy through its overall asset allocation framework and geographical distribution, in addition to the selection of attractive sectors.

The Fund focuses on two main investment categories: Public Markets Assets (tradable) that include global equity, fixed income bonds and short-term assets, and Private Markets Assets (non-tradable) which includes private investments in real estate, logistics, services, commercial, and industrial projects.

Real estate with its different asset types and strategies is considered to be amongst the strong investment sectors; depending on the strategy and the allocation along the risk spectrum. Real estate offers capital preservation attributes and long-term income generation. Real estate investment is selected (taking into consideration each market) by diversifying among investments in tourism, commercial, or residential properties. The Real Estate department in SGRF diversifies its portfolio between core/core-plus, value-added and development projects to achieve the desired risk and return profile.

SGRF’s core real estate assets are defined as direct investments in developed markets benefiting from longterm lease contracts with strong tenant covenants aiming to achieve sustainable income. On the value-added real estate assets and development projects, SGRF enters into partnerships with real estate partners and developers in emerging and developed markets to leverage on their technical knowledge and expertise.

Contrary to the investment in real estate assets and development, which is direct investment for SGRF, real estate is one of the Fund’s indirect investments. Through its investment in major real estate funds, SGRF relies on the extensive experience and knowledge of the managers of these funds.

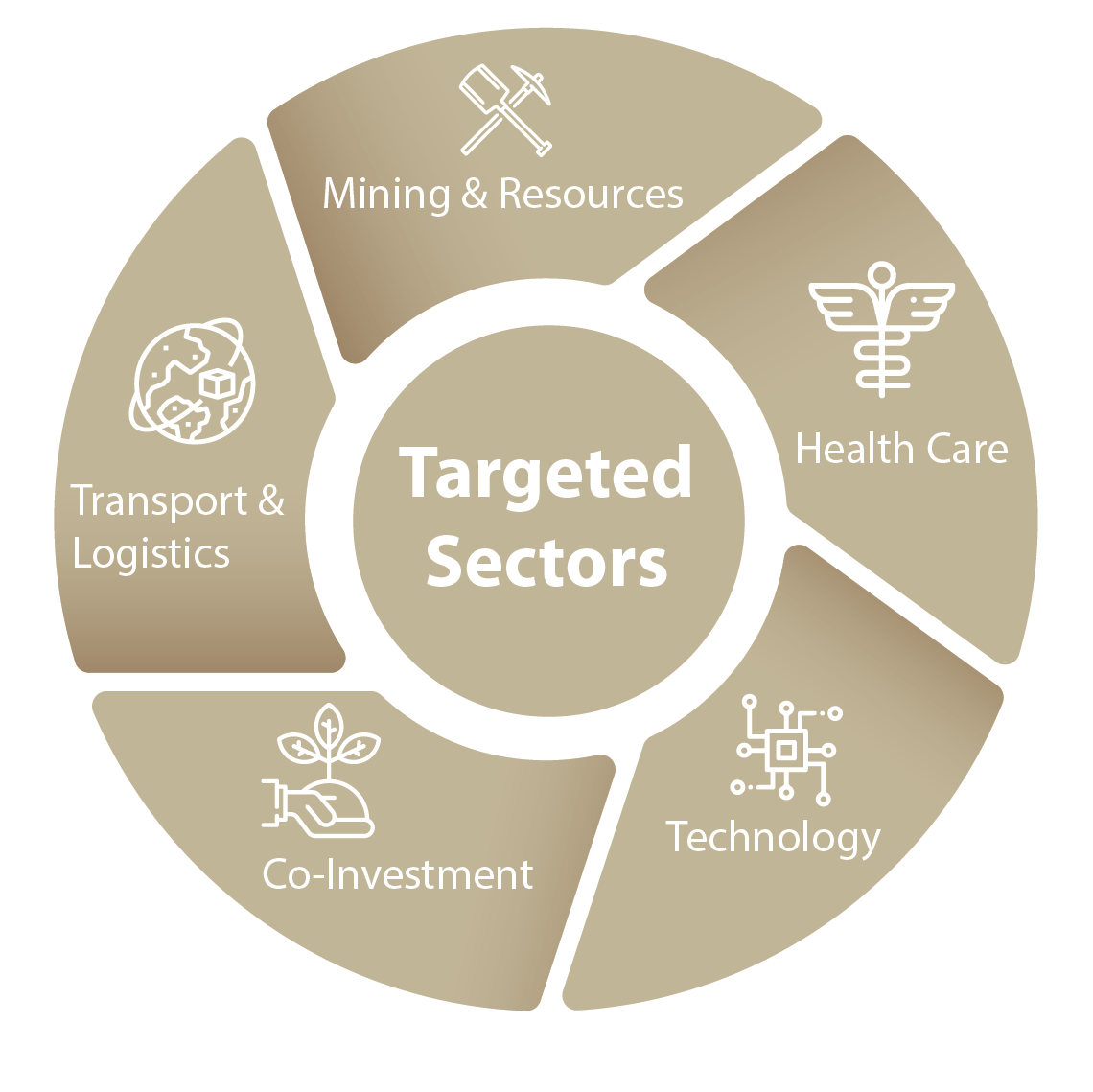

We at OIA, invest for a better future and sustainable development for generations to come. Hence, we are working to diversify our investments to serve this goal as well as other goals of the fund-. In addition to our investments in different continents of the world, we are targeting a number of areas where we believe in their ability to achieve economic and social added value for the people of the Sultanate of Oman and the economy as a whole.

The targeted sectors include those associated with the food industry, building materials industries and health services, which is one of the most important sectors that ensures the achievement of a decent life for future generations in the Sultanate and which is within the sectors of focus for the Omani government, promoted through local initiatives and entering into regional and international investments across the government various investment arms.

In addition, the logistics sector and related projects is considered as one of the key infrastructural sectors upon which a large number of pharmaceutical, mining industries and other projects are based.

The Technology sector forms one of the promising areas to create sustainable economic opportunities in the Sultanate and the Fund will also focus on promising economic sectors such as mining and hospitality, as well as energy field related projects, especially renewable ones.

More importantly, the government is targeting to focus on projects and initiatives that aim at developing the necessary knowledge and skills in recent/modern economic sectors in the Sultanate. Consequently, the Sultanate will become a platform for the provision of competencies and skills of higher qualifications in different present and future growth sectors.

The State General Reserve Fund, with its extensive network of international contacts and relations, aims to harness these connections to bring in international investments to the Sultanate including local investment initiatives adopted by OIA. Through fulfilling this objective, OIA is a link in the search for the most suitable global investment partners and a catalyst for the launch of new economic projects, in line with OIA's investment trends in local affairs.

Investments in this sector include financial securities subject to circulation that can easily be converted into cash any time at a reasonable cost. This class includes three major assets: global equities, international bonds, and short-term assets.

The Global equities portfolio invests in several main areas around the globe: North America, Europe, Asia Pacific, and emerging markets. These regions are comprised of more than 46 countries, which allows the fund to diversify its investments, leading to lower risks exposure. The Fund investments vary across ten economic sectors.

These diversify the investment portfolio consistently with changes in international markets among the type of investments and the targeted areas. The aim is to minimize negative impact that may result due to adverse economic changes. The public market portfolio also invests in 35 bonds markets around the world. The Fund is continuously seeking investments and strategies around the parameters of public markets, which develop and diversify the returns of the portfolio.

The assets of these portfolios vary and include government bonds in the emerging and developed markets, in addition to bonds issued by establishments with high ratings and sovereign Sukuks, Short-term assets including American Treasury Bills and deposits in local banks.

OIA takes a cautious approach in selecting the appropriate External Investment Manager based on the specified sector and investment area. The External Manager analyses market opportunities in accordance with the investment strategy of OIA, and raises recommendations to the relevant committees to make the appropriate decision.

OIA continuously monitors the performance of External Investment Managers and ensures compliance with OIA’s directives with respect to the performance criteria. OIA works closely with them to benefit from their resources in research, technical skills and knowledge transfer.

Vietnam Oman Investment (VOI)

Vietnam Oman Investment (VOI) was established in 2008 as a joint venture between Oman Investment Authority (OIA) and the State Capital Investment Corporation of Vietnam with an initial capital of USD 75 million, which was subsequently increased by an additional USD 125 million. VOI invests in Vietnamese companies and projects, contributing to developing the Vietnamese economy and creating sustainable economic growth.

Oman India Joint Investment Fund (OIJIF)

Oman India Joint Investment Fund (OIJIF) was established in 2011 as a joint venture between Oman Investment Authority (OIA) and the State Bank of India to invest in various sectors within India. OIJIF Fund was established with a corpus of USD 100 million and has been fully invested. OIJIF Fund II was established with a corpus of USD 240 million and is currently being invested.

Uzbek Oman Investment Joint Venture (UOI)

Uzbek Oman Investment Joint Venture (UOI) was established in 2010 as a joint venture between Oman Investment Authority (OIA) and the Fund for Reconstruction and Development of Uzbekistan (FRD) to invest in Uzbekistan with an initial capital of USD 100 million, later increased to USD 200 million in 2017.

Oman Brunei Investment Company

Oman Brunei Investment Company was established in 2009 as 50-50 joint venture between Oman Investment Authority (OIA) and Brunei Investment Authority (BIA). The JV was founded with an initial capital of USD 100 million further increased in 2019 to USD 200 million. The company mainly invests various sectors within Oman.

Spain Oman Private Equity Fund

The Spain Oman Private Equity Fund was established in 2014 with a capital of EUR200 million. It is a 50-50 joint investment between OIA and COFIDES a Spanish state-owned company, which provides financial support to Spanish enterprises abroad. The JV aims to invest in Spanish companies within various sectors looking to expand their operations in the GCC, East Africa, India, South East Asia and Latin America.

2019 Highlights

- 2019 was the Fund’s first year of operation

- 3 investments completed:

-Palacios, a leading specialist producer of Spanish food products and ready to eat meals

-Haizea Wind Group, a leading manufacturer of structures and components for windmills with facilities in Spain and Argentina

-TCI Cutting, dedicated to the design and manufacture of industrial cutting machines, specialized in laser and water jet cutting technologies

CMBI Neo-Momentum Fund

The CMBI Neo-Momentum Fund was established in 2020 as a partnership between Oman Investment Authority (OIA) and China Merchant Bank International (CMBI) with a minimum fund size of USD 300 million. The fund will target investments in Chinese sectors such as ICT, New Energy, Healthcare and Logistics.

Pak Oman Investment Company Limited

Pak Oman Investment Company Limited was established in 2001 as a joint venture between the Omani and Pakistani governments with an initial capital of USD 100 million. The JV's objectives are to promote economic growth in Pakistan and Oman through industrial development and agro-based industries.

Al Hosn Investment Company (HIC)

Al Hosn Investment Company was established in 2007 as a partnership between Qatar Investment Authority (QIA) and Oman Investment Authority (OIA) with a total committed capital of RO 100 million. The company targets investments within Oman and other GCC in key economic sectors including healthcare, education, food security, real estate, industrial, manufacturing, technology, hospitality and tourism.

We at OIA, invest for a better future and sustainable development for generations to come. Hence, we are working to diversify our investments to serve this goal as well as other goals of the Fund. In addition to our investments in different continents of the world, we are targeting a number of areas where we believe in their ability to achieve economic and social added value for the people of the Sultanate of Oman and the economy as a whole. We are also working to harness the vast network of our international relations to bring international investments to the Sultanate, which are in line with the State’s plan.

The targeted sectors include those associated with the food industry, building materials industries and health services, which is one of the most important sectors that ensure the achievement of a decent life for future generations in the Sultanate, and which is within the sectors of focus for the Omani government, promoted through local initiatives and entering into regional and international investments across the government various investment arms.

In addition, the logistics sector and related projects is considered as one of the key infrastructural sectors upon which a large number of pharmaceutical, mining industries and other projects are based. The technology sector forms one of the promising areas to create sustainable economic opportunities in the Sultanate.

More importantly, the government is focusing on projects and initiatives that aim at developing the necessary knowledge and skills in recent/modern economic sectors in the Sultanate. Consequently, the Sultanate will become a platform for the provision of competencies and skills of higher qualifications in different present and future growth sectors.